Where great companies

meet great odds..

Traversing new territories with ixigo

Cashify, the capital of the used smartphones world.

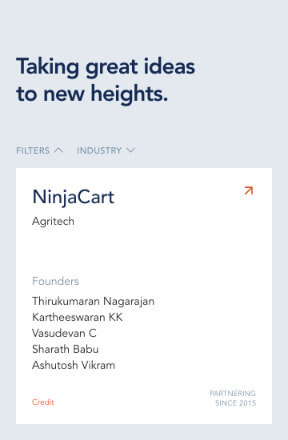

Helping Ninjacart grow fivefold in 3 years.

Designing a financial journey for Livspace

Helping Big Basket bag the coveted top spot.

Expanding the footprint of Blowhorn

Unpacking scale at Bizongo

Venture Debt: The Rising Tide Of Credit In The New Economy

The people of startups - by the numbers.

Multiplying Vedantu’s footprint in ed-tech.

Supporting the pillars of growth for Infra Market.

Helping Cars24 shift gears in the market

Creative

Capital

Long-term

Support

Preferred

Access

Thought

Leadership

Maximizing

Potential

Grow faster

and further

Financial offerings designed

to help you at every step of

your journey to success.

our journey

Supporting content to commerce revolution

in India.

Backing Good Glamm Group Since 2020.

our journey

We’ve built a new asset class in India.

Invested INR 6,000+ Cr in startups since 2015.

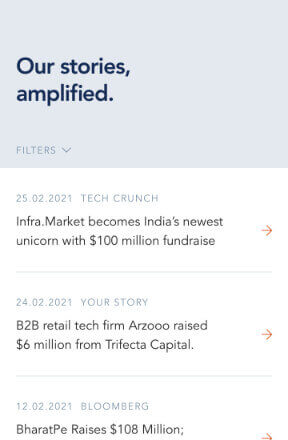

PORTFOLIO UPDATES

Feb 27

Shadowfax raises $100 million from TPG NewQuest, Flipkart, and others

PORTFOLIO UPDATES

Jan 29

India’s Uber-rival BluSmart pumps up EV charging with $25M investment

PORTFOLIO UPDATES

Jan 18

Groyyo raises $5.4 Mn in debt round

INDUSTRY INSIGHTS

Jan 16

2024 For Startups: The Season Of Revival

PORTFOLIO UPDATES

Jan 09

MyMuse Bags $2.7 Mn To Bolster Omnichannel Presence

INDUSTRY INSIGHTS

Jan 02

Venture debt gains ground in Indian startups amid equity fund raising dip

our journey

Supporting leading startups building for Bharat.

Backing Meesho since 2021.

Since we partnered with

Urban Company in 2015,

the startup grew

to a $2.8BN valuation,

and became the

#1 tech-enabled

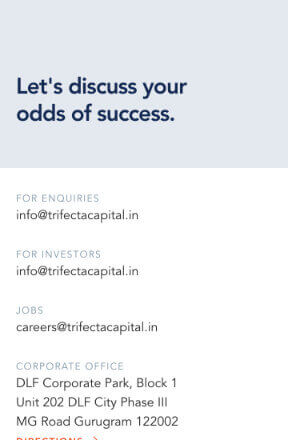

home services company in India. What are your odds of success?

Let's find out